Thriving on the Fertile Ground of Value Investment

Thriving on the Fertile Ground of Value Investment

Thriving on the Fertile Ground of Value Investment

Investment Results

Fixed Income

Fixed Income

Fixed Income

Effective and in-depth macro research provides top-down investment guidance for bond investment.

In-depth internal research supports sustained excellent performance

Create excess returns through active investment and effective risk control.

The investment process should strictly adhere to the rules.

Seek continuous innovative approaches.

Effective and in-depth macro research provides top-down investment guidance for bond investment.

In-depth internal research supports sustained excellent performance

Create excess returns through active investment and effective risk control.

The investment process should strictly adhere to the rules.

Seek continuous innovative approaches.

Effective and in-depth macro research provides top-down investment guidance for bond investment.

In-depth internal research supports sustained excellent performance

Create excess returns through active investment and effective risk control.

The investment process should strictly adhere to the rules.

Seek continuous innovative approaches.

Innovation Investment

Innovation Investment

Innovation Investment

The company's research includes a comprehensive research system such as macroeconomic and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

The company's research includes a comprehensive research system such as macroeconomic and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

The company's research includes a comprehensive research system such as macroeconomic and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

Equity Investments

Equity Investments

Equity Investments

The risk-return ratio of the combination is the ultimate goal

We firmly believe in the effectiveness and necessity of active portfolio investment, broaden our thinking, continuously increase innovative varieties, and optimize the combination

The risk-return ratio of the combination is the ultimate goal

We firmly believe in the effectiveness and necessity of active portfolio investment, broaden our thinking, continuously increase innovative varieties, and optimize the combination

The risk-return ratio of the combination is the ultimate goal

We firmly believe in the effectiveness and necessity of active portfolio investment, broaden our thinking, continuously increase innovative varieties, and optimize the combination

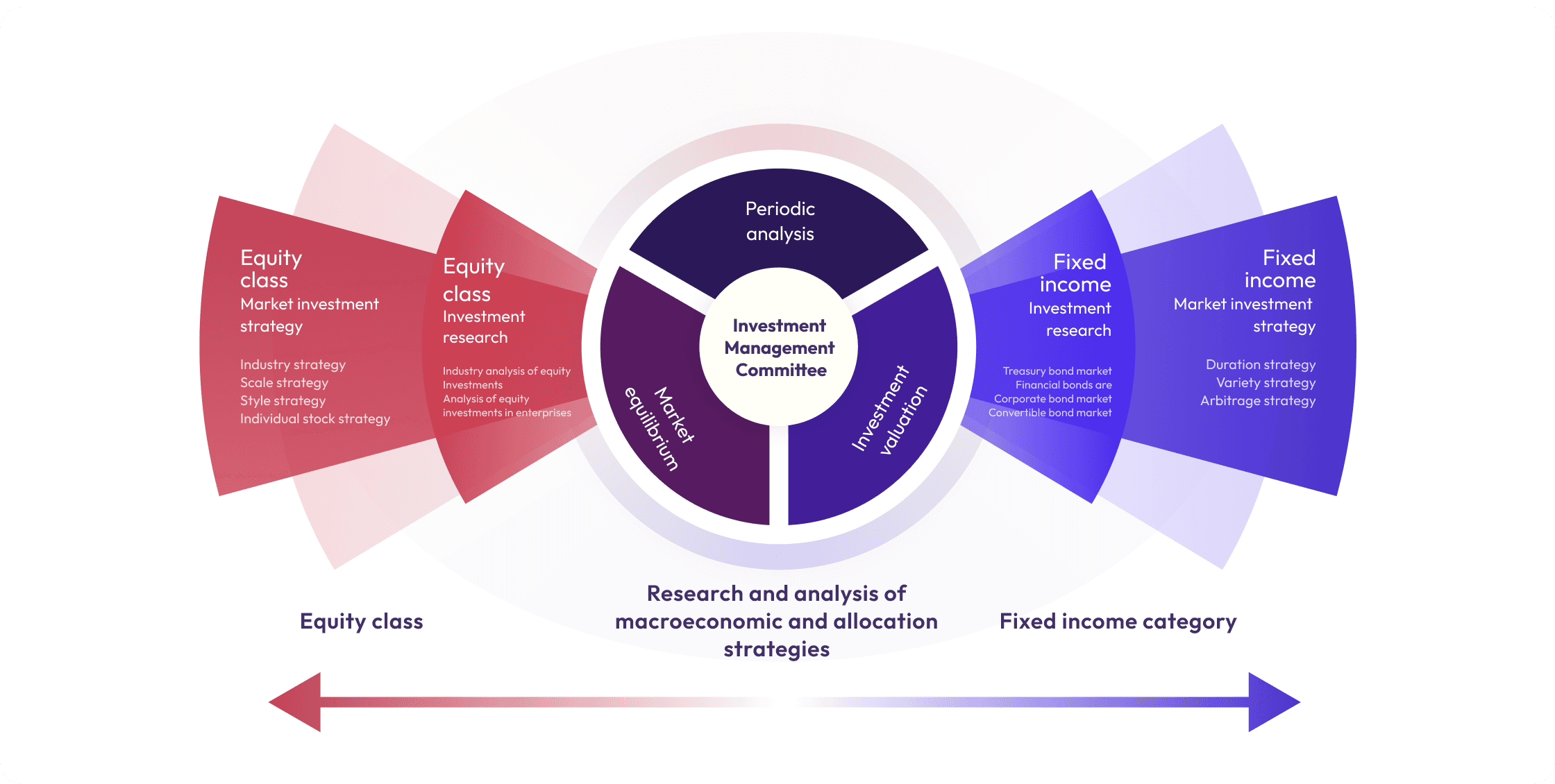

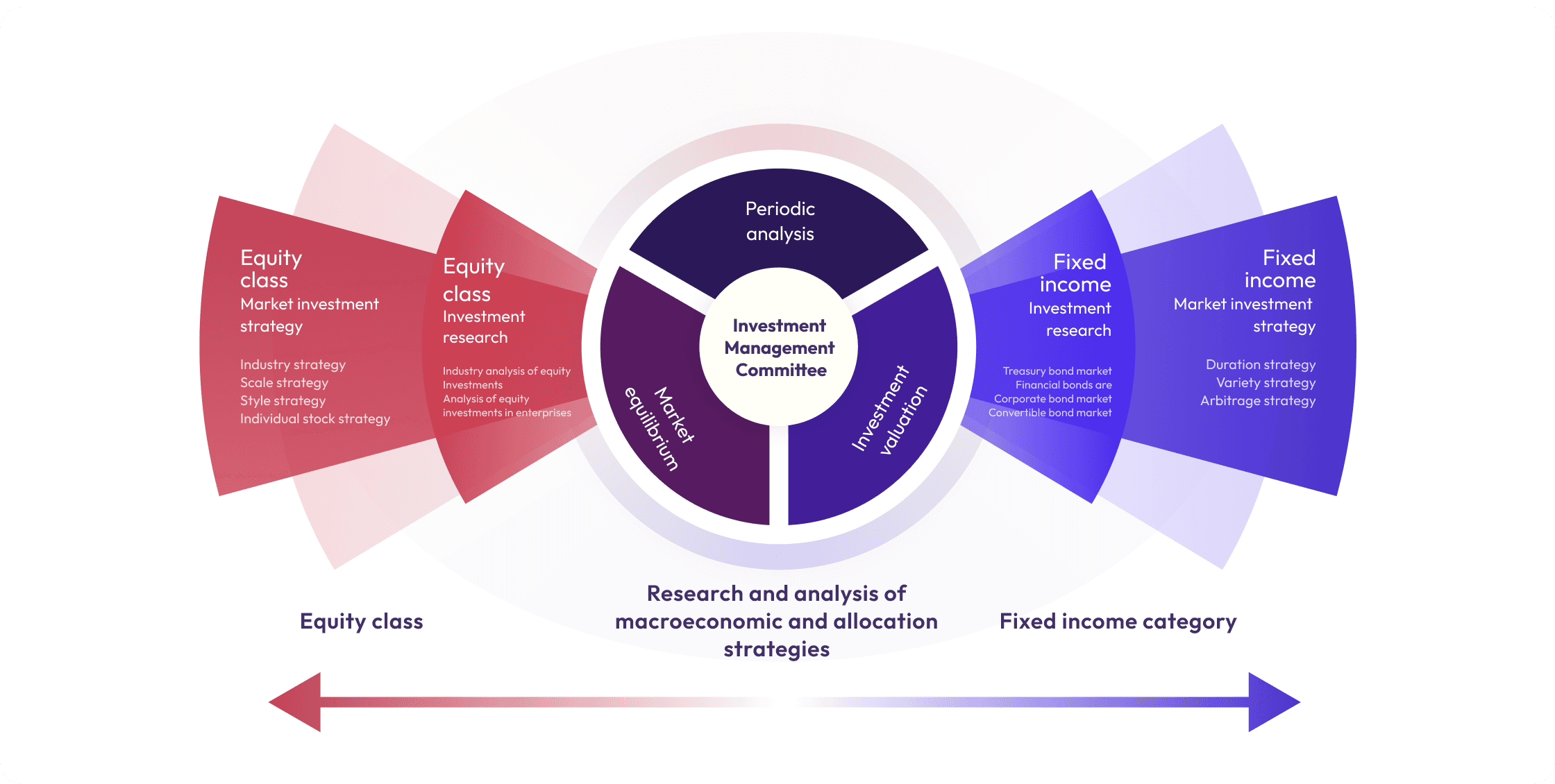

Introduction to the research system framework

Introduction to the research system framework

The company's research work adheres to the concept of "leading research, team management", pursues the idea of creating value through research, follows the law of value, and all securities investment decisions should be based on internal research results, conduct research analysis based on publicly available market information, and explore investment opportunities.

The company's research work adheres to the concept of "leading research, team management", pursues the idea of creating value through research, follows the law of value, and all securities investment decisions should be based on internal research results, conduct research analysis based on publicly available market information, and explore investment opportunities.

The company's research work adheres to the concept of "leading research, team management", pursues the idea of creating value through research, follows the law of value, and all securities investment decisions should be based on internal research results, conduct research analysis based on publicly available market information, and explore investment opportunities.

LTD

Renewable power

LTD

Renewable power

LTD

Renewable power

Introduction to Fixed Income Investments

Introduction to Fixed Income Investments

Introduction to Fixed Income Investments

Fixed income financial products refer to products that mainly invest in fixed income assets such as deposits and bonds, and the proportion of such assets is not less than 80%. As of the end of June 2023, the outstanding scale of fixed income financial products reached 24.11 trillion, accounting for 95.15% of the total scale of financial products, and is currently the most mainstream type of financial product.

Fixed income financial products refer to products that mainly invest in fixed income assets such as deposits and bonds, and the proportion of such assets is not less than 80%. As of the end of June 2023, the outstanding scale of fixed income financial products reached 24.11 trillion, accounting for 95.15% of the total scale of financial products, and is currently the most mainstream type of financial product.

Fixed income financial products refer to products that mainly invest in fixed income assets such as deposits and bonds, and the proportion of such assets is not less than 80%. As of the end of June 2023, the outstanding scale of fixed income financial products reached 24.11 trillion, accounting for 95.15% of the total scale of financial products, and is currently the most mainstream type of financial product.

Broadly speaking, we can divide fixed-income products into two categories: fixed income plus and pure fixed income. The biggest difference lies in the allocation of equity assets. As shown in the diagram below, different underlying asset investments result in different risk-return characteristics.

Broadly speaking, we can divide fixed-income products into two categories: fixed income plus and pure fixed income. The biggest difference lies in the allocation of equity assets. As shown in the diagram below, different underlying asset investments result in different risk-return characteristics.

According to the fund term, funds with high liquidity requirements can be placed in cash management products, because these products often invest in underlying assets with relatively short terms, emphasizing short-term stable performance and also paying attention to redemption liquidity needs; funds that are not used for a period of time can choose fixed-income products with different holding periods or closed-end fixed-income products. The yield elasticity of these products is relatively higher than that of cash management products, so from a long-term perspective, there is hope to meet everyone's goal of steady value appreciation.

According to the fund term, funds with high liquidity requirements can be placed in cash management products, because these products often invest in underlying assets with relatively short terms, emphasizing short-term stable performance and also paying attention to redemption liquidity needs; funds that are not used for a period of time can choose fixed-income products with different holding periods or closed-end fixed-income products. The yield elasticity of these products is relatively higher than that of cash management products, so from a long-term perspective, there is hope to meet everyone's goal of steady value appreciation.

Research System Framework Introduction

Research System Framework Introduction

Aurora Solutions has innovative funds in fund investment targets, profit distribution, governance structure, fee structure or management model.

Aurora Solutions has innovative funds in fund investment targets, profit distribution, governance structure, fee structure or management model.

Aurora Solutions has innovative funds in fund investment targets, profit distribution, governance structure, fee structure or management model.

LTD

Cost-effective

LTD

Cost-effective

LTD

Cost-effective

Innovative Investment Business

Innovative Investment Business

Innovative Investment Business

The company's research includes a complete research system on macroeconomics and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

The company's research includes a complete research system on macroeconomics and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

The company's research includes a complete research system on macroeconomics and policy research, bond research, new energy infrastructure, FOF, investment strategy research, industry research, and listed company research.

Innovative Investment Headquarters strategically aims to build a stable and diversified profit model. Its business covers various categories including fixed income, equities, commodities, derivatives, bills, OTC market making, etc. By promoting 'business innovation, concept innovation, technology innovation, model innovation, and financial technology innovation,' it develops an innovative proprietary investment model covering all categories. With strong research capability, product design capability, trading management capability, asset pricing capability, risk management capability, etc., it expands into various capital intermediation businesses such as investment advisory, financial advisory, product development, sales trading, and securities market making. This department is turning into a leading integrated financial service provider with strong innovation capability, leading business model, outstanding value creation, and abundant profit resources.

Innovative Investment Headquarters strategically aims to build a stable and diversified profit model. Its business covers various categories including fixed income, equities, commodities, derivatives, bills, OTC market making, etc. By promoting 'business innovation, concept innovation, technology innovation, model innovation, and financial technology innovation,' it develops an innovative proprietary investment model covering all categories. With strong research capability, product design capability, trading management capability, asset pricing capability, risk management capability, etc., it expands into various capital intermediation businesses such as investment advisory, financial advisory, product development, sales trading, and securities market making. This department is turning into a leading integrated financial service provider with strong innovation capability, leading business model, outstanding value creation, and abundant profit resources.

Introduction to Research System Framework

Introduction to Research System Framework

The risk-return ratio of the portfolio is ultimately the pursuit of the effectiveness and necessity of active portfolio investment, broadening thinking, strengthening learning, and constantly increasing innovative varieties and optimizing portfolio

LTD

Cost-effective

LTD

Cost-effective

LTD

Cost-effective

Equity Investments

Equity Investments

Invest in equity assets such as stocks and stock funds

Invest in equity assets such as stocks and stock funds

Stocks are the abbreviation of stock certificates, which are issued by a joint-stock company to raise funds and issued to shareholders as proof of ownership and to obtain dividends. Each share of stock represents the ownership of a basic unit of the enterprise.

Securities Investment Fund - refers to a collective securities investment method in which benefits are shared and risks are borne collectively. That is, through the issuance of fund units, investors' funds are centralized, held in custody by a fund custodian (usually a reputable bank), and managed and utilized by a fund manager (i.e. a fund management company) to engage in investment in financial instruments such as stocks and bonds. Fund investors enjoy the returns from securities investment and also bear the risks associated with investment losses. In simple terms, a securities investment fund is a tool for the collective investment of funds from numerous investors, which are uniformly entrusted to investment experts for investment in financial products such as stocks and bonds, thus serving as an investment tool for the benefit of numerous investors.

Equity Investments

Invest in equity assets such as stocks and stock funds

Stocks are the abbreviation of stock certificates, which are issued by a joint-stock company to raise funds and issued to shareholders as proof of ownership and to obtain dividends. Each share of stock represents the ownership of a basic unit of the enterprise.

Securities Investment Fund - refers to a collective securities investment method in which benefits are shared and risks are borne collectively. That is, through the issuance of fund units, investors' funds are centralized, held in custody by a fund custodian (usually a reputable bank), and managed and utilized by a fund manager (i.e. a fund management company) to engage in investment in financial instruments such as stocks and bonds. Fund investors enjoy the returns from securities investment and also bear the risks associated with investment losses. In simple terms, a securities investment fund is a tool for the collective investment of funds from numerous investors, which are uniformly entrusted to investment experts for investment in financial products such as stocks and bonds, thus serving as an investment tool for the benefit of numerous investors.